(Post 137 of 263. Thanks again to those who participated in the Fundrazr. As I mentioned in the post announcing Bast’s passing from COVID, I thank everyone for your generous donations to the original Fundrazr campaign, which resulted in sponsored 263 posts. I will continue to honour the commitment to write those 263 posts, but I will not commit to more. The link above is to a new campaign to help Bast’s family.)

I’ve only been with BBVA a few days and what a breath of fresh air it has been! Ride share and food delivery platform payments go through nearly instantly, I was able to just scan the barcode on my power bill for all the payee info to be inputted for a payment (and the payment went through!), a global money transfer came in a day earlier than it would have with HSBC, and transfers in from other Mexican banks happen near instantly, not a few hours later. I still have a lot of tests to put the account through, but I can already tell the switchover is going to really reduce stress in my daily life.

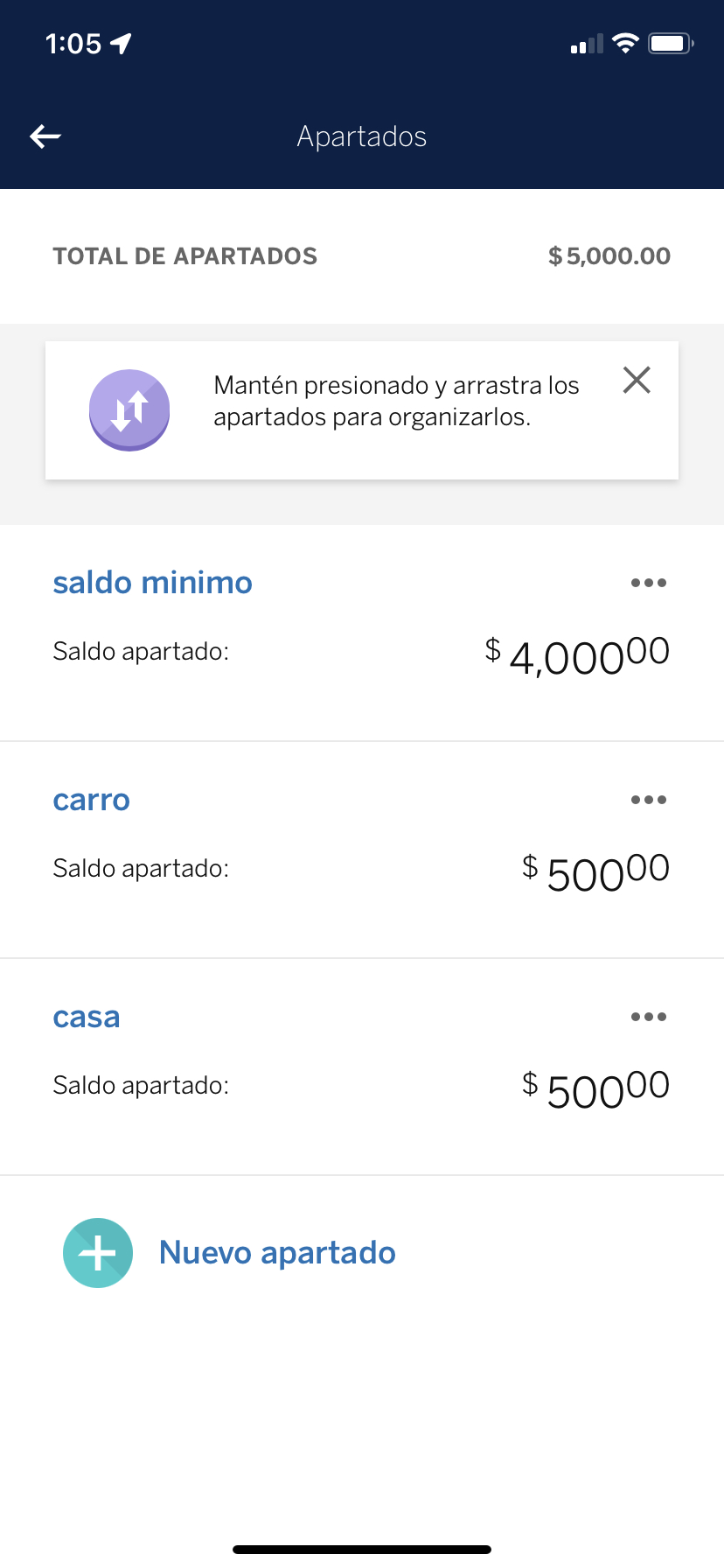

There are so many advanced features to my account that I still haven’t discovered them all. My current favourite is “apartados” — partitions. You can separate your account into up to seven partitions to help with budgeting. So let’s say I get a payment of $60,000 and I want to remove my mortgage payment from my main account balance as well as start saving for a car. Let’s say all of that totals $45,00. I can move amounts to my “mortgage” and “car” partitions and then my main account balance showing available funds for debit and automatic payments is just $15,000 even though I still have $60,000 in that account. That sure beats having to open up a bunch of separate accounts, the way I know a lot of people budget. The only disadvantage is you can’t tell an automatic payment to come out of a partition, so you have to set reminders to move the money into the main partition when needed. So I think the greatest use of this system is with short-term savings where you’re not concerned about getting interest.

This is an example to show what it looks like in the app. My balance showing in the account is minus this $5,000 that I’ve set aside.

I have been using software to do this for years and it is a real headache to balance accounts. You really have to trust your data entry to be able to trust the software balance as your real “available” balance versus what the bank says it is. Having this feature built right into my main account for daily use is going to simplify my bookkeeping so much. That’s the kind of thing you get excited about when business is booming and bookkeeping is starting to be a real chore!